Disposable Hygiene Market in Latin America: Exploring Current Scenario And Future Evolution

The Disposable Hygiene market in Latin America is at a pivotal moment of transformation: the region’s cultural, economic, and demographic diversity creates a dynamic landscape filled with both challenges and opportunities.

Amid these challenges, several key trends are emerging that will define the future of the Disposable Hygiene market.

Key Trends Shaping Latin America’s Disposable Hygiene Market

Latin America is a continent of contrasts, presenting different financial landscapes, demographic dynamics, and cultural nuances. However, a few key macro trends cut across the region and are shaping the Disposable Hygiene market.

- Declining Birth Rates: Latin America's falling birth rates are significantly altering the baby care market, with fewer newborns impacting the demand for both diapers and pants.

- Women’s Empowerment: The growing economic power of women is reshaping the menstrual care market, driving a substantial volume growth as their purchasing capacity increases.

- Aging Population: As the region's population ages, the number of individuals facing incontinence issues continues to rise, driving rapid volume growth in the adult incontinence market.

To better understand the ongoing market dynamics, it is necessary to analyze each key segment in detail, considering how these trends are influencing the different aspects of the Disposable Hygiene market in Latin America.

Baby Diapers: How Declining Birth Rates Are Redefining the Market

The baby diaper market in Latin America is experiencing significant shifts due to declining birth rates, a trend that accelerated unexpectedly in 2023. According to America’s Quarterly, between 2013 and 2022, births fell between 10% and 34% in eight Latin American countries that account for two-thirds of the region’s total population. Factors like urbanization, career-focused women, and a growing reluctance to have children are highly contributing to such phenomenon. Additionally, better access to contraception empowers women to control family planning, resulting in fewer adolescent pregnancies, more intentional family planning, and a significant drop in birth rates. This has led to stagnating demand for baby diapers, with volumes expected to see a slight decrease in the coming years: a -1.3% for baby diapers and -0.2% CAGR for pants is expected by 2028.

Despite shrinking demand, rising inflation and sale growth of baby pants still support value increase across the category. Additionally, the overall value of the baby segment has also increased due to parents' growing preference for premium products. In countries like Uruguay, premium disposable baby diaper lines are highly popular, with consumers showing strong loyalty to these products.

As Latin American families become smaller, brands must prioritize the development of superior products that meet the demands of parents seeking quality, ease of use, and comfort for their babies. Premiumization will continue to play a key role in addressing these shifting needs.

Women’s Economic Empowerment: A Game Changer for Menstrual Care Products

In the ever-changing market landscape of hygiene products, the menstrual care market in Latin America is seeing dynamic growth, fueled by the increasing economic empowerment of women. According to the World Economic Forum, gender equality is advancing across the region, with women gaining more access to education, employment, and financial resources. These transformations are contributing to higher demand for sanitary protection products.

In 2023, the menstrual care segment rebounded from pandemic-driven declines. While the market volume is expected to grow at a modest rate of +2% CAGR through 2028, the market value is forecasted to increase by +24% during the same period, reflecting consumers’ shift toward premium, higher quality products.

The World Bank also highlights efforts to improve women’s economic and social inclusion, further boosting awareness towards menstrual management practices as well as purchasing power. As a result, the menstrual care market is growing in both volume and value, presenting significant opportunities for brands to cater to this increasingly empowered consumer base.

Capturing Growth in Adult Incontinence Products

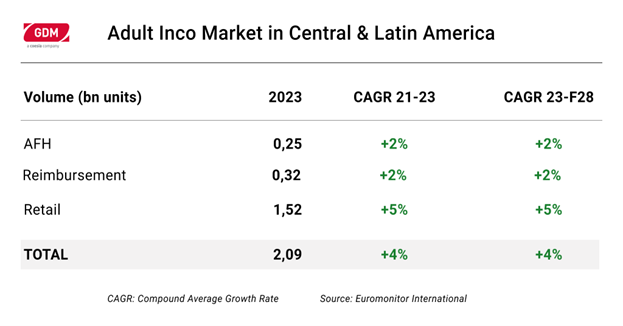

The third trend shaping the evolution of the Disposable Hygiene market in Latin America is fast aging population, which creates significant opportunities within the Disposable Hygiene market, particularly for adult incontinence products. According to ECLAC, the region is undergoing rapid demographic changes, with people aged 60 and over expected to represent 25.1% of the population by 2050. As the number of older adults increases, so does the prevalence of medical conditions like incontinence, driving demand for incontinence products: in 2023, the adult incontinence market in the region reached a volume of 2.09 billion units and it’s expected to further expand.

Through 2028, it is forecasted to grow at a steady 4% CAGR, with the retail segment expected to lead the growth at 5% CAGR, while AFH (Away from Home) and Reimbursement segments are projected to grow at 2% CAGR during the same period. Governments and healthcare providers, in fact, are increasingly focusing on awareness and care for older adults, which further accelerates market growth.

According to The Economist, falling fertility rates in the region are also shifting economic priorities toward providing better care for an aging population, further boosting the need for incontinence solutions.

As awareness of incontinence increases and products become more accessible and discreet, manufacturers are positioned to capitalize on this growing demand. The market offers significant potential, not only in terms of volume but also in the development of high-performance products that cater to the evolving needs of the elderly population in Latin America.

How Consumer Behavior and Channels Are Evolving in Latin America

Across all segments of the Disposable Hygiene market, traditional retail channels such as supermarkets and hypermarkets remain dominant. However, e-commerce is quickly gaining traction as consumers increasingly prioritize convenience, broader product selection, and competitive pricing.

For manufacturers, adapting to these changes in consumer behavior is crucial. Offering omnichannel purchasing options can help reaching a broader consumer base and increase brand loyalty by providing seamless shopping experiences across multiple platforms.

How Can Manufacturers Thrive in Latin America’s Evolving Market?

- Seize Market Value Opportunities: Manufacturers should capitalize on opportunities by developing innovative products that address specific market demands, such as convenience and skin health. This will help companies establish a foothold in the Latin American market and achieve sustained profitability.

- Leverage Premiumization: Premiumization is driving value growth despite falling consumption. In countries like Uruguay, retail volume of diapers fell considerably in 2023 due to declining birth rates and small-scale smuggling from Argentina. However, the market value grew as consumers opted for premium products offering better performance and skin care benefits. Brands that offer superior quality are standing out in this competitive market.

- Target Women Consumers: Women’s economic empowerment in Latin America presents a significant opportunity. Companies should focus their marketing efforts on appealing to this demographic, particularly in the menstrual care, but also across segments. Women, in fact, still function as main caregiver in most families, thus being the primary purchasers of disposable hygiene products.

- Embrace E-Commerce: As e-commerce continues to grow, manufacturers should invest in building strong online sales channels. Offering personalized shopping experiences and fast, reliable delivery options will help capture this rapidly expanding segment.

Seizing Opportunities in a Market of Contrasts

The Disposable Hygiene market in Latin America is complex, yet full of potential. While challenges like declining birth rates and rising inflation are reshaping the baby care segment, opportunities are emerging in the adult incontinence and menstrual care sectors.

GDM is here to help you navigate these market dynamics and ensure your products meet the needs of today’s Latin American consumers.