European disposable hygiene market: what changing demographics and consumer priorities reveal

At first glance, the European disposable hygiene market appears stable, defined by established consumption habits, structured retail networks and mature economies. And yet, beneath this apparent solidity, powerful forces are at work. A continent that is growing older, more diverse and economically cautious is reshaping the needs, expectations and access to hygiene essentials.

To read this market today is to understand how demography, affordability, retail habits and values converge, not in abstraction but in products used by millions every day. This convergence defines both the complexity and the potential of a sector in motion.

The EU disposable hygiene market at a glance: growth patterns and retail dynamics

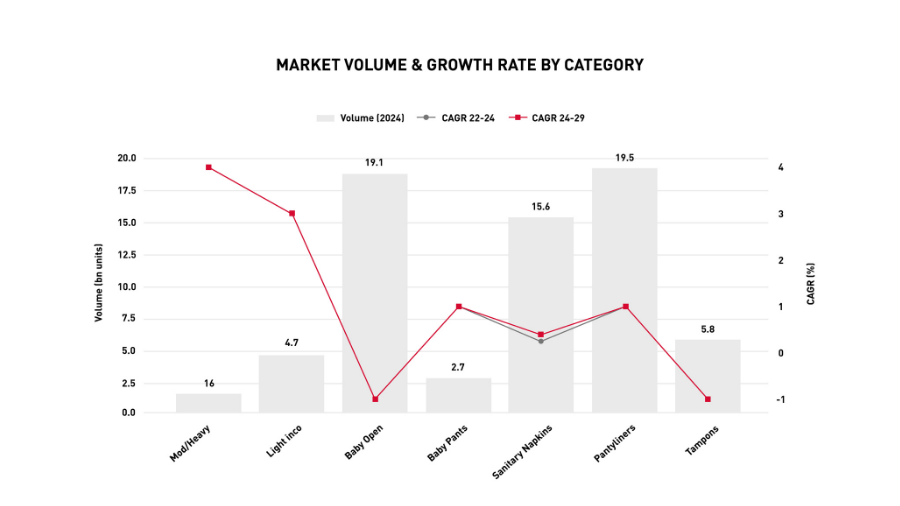

In 2024, the European disposable hygiene product market reveals a multifaceted scenario shaped by demographic shifts, product innovation, and evolving retail behaviors. According to Euromonitor data[1], the sector reached 69 billion units in retail volume, with markedly different trajectories across product categories:

Adult incontinence stands out as the most promising segment, driven by demographic pressure and rising attention to personal wellbeing. In steady growth are moderate and heavy incontinence products (+4% CAGR 2024-2029) and light incontinence products (+3% CAGR 2024-2029), supported by improvements in fit, skin protection and fluid retention.

Baby diapers, instead, show more fragmented signals. Open-format products are slightly contracting (-1% CAGR 2024-2029), while baby pants retain modest growth (+1% CAGR 2024-2029), particularly in Northern and Western Europe. They appeal to parents who value practicality and ease of use in everyday care.

Menstrual care maintains stable volumes, but with a gradual shift toward more specialized and sustainable solutions. These include organic cotton pads, bio-based and fragrance-free options, with pantyliners leading growth (+1% CAGR 2024-2029), sanitary napkins remaining nearly flat (+0.4% CAGR 2024-2029) while tampons decline (-1% CAGR 2024-2029).

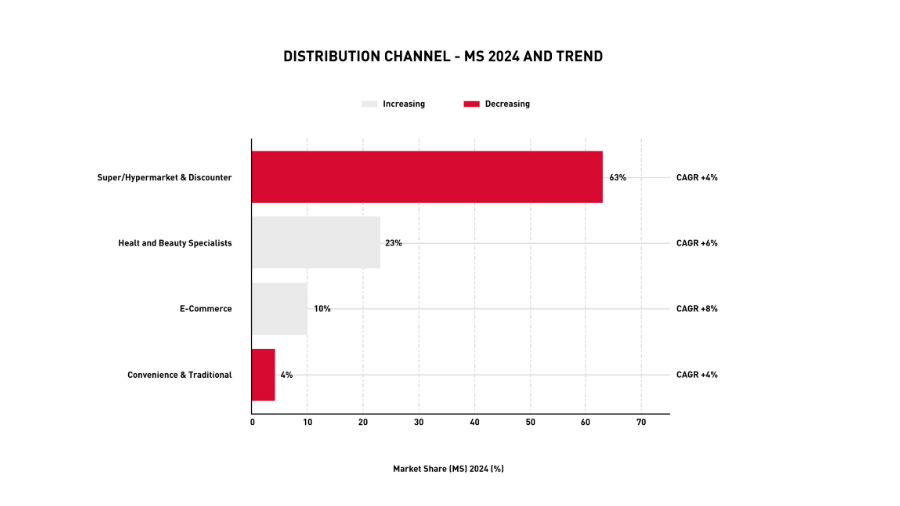

Retail structure is evolving, though traditional formats still lead. Supermarkets, hypermarkets and discount stores account for 63 percent of sales (+4% CAGR 2022-2024). Yet online platforms are growing fast (+8% CAGR 2022-2024), supported by subscription services and mobile-first interfaces. Health and beauty specialists are also expanding (+6% CAGR 2022-2024), especially where targeted advice and sensitive skin products are in demand.

As digital behaviours become more ingrained, social commerce is gaining visibility across Europe. Nearly half of consumers (46%) have made purchases through social platforms, and 72 percent still value the reassurance of physical stores.[2] While this trend spans multiple sectors, it is reshaping expectations around convenience and trust, including in hygiene retail.

Demographic transitions and their market impact

The trends observed in disposable hygiene products market and retail dynamics are rooted in deeper structural shifts: chief among them, the demographic transformation of Europe.[3]

Europe’s population is aging rapidly. In 2024, more than one in five residents is over 65, and 6.1% are above 80. This demographic shift influences everyday consumption, with increasing demand for adult incontinence solutions that combine discretion, comfort, and performance. The expansion of this segment is not temporary: it reflects long-term structural change in most EU countries.

At the other end of the age spectrum, birth rates continue to decline. Countries such as Italy, Spain and Greece report crude birth rates of 6.4, 6.6 and 6.8 live births per 1,000 persons respectively. Consequently, the share of the population under 15 has fallen (from 16.2% in 2004 to 14.6% in 2024). Baby care volumes are adjusting to this narrower base. Traditional open-format diapers are gradually losing relevance, while baby pants maintain a modest edge in markets where fast-paced lifestyles and ease of use are a priority. At the same time, the category is experiencing a clear premiumization trend: improvements in skin protection, materials and design are helping sustain value growth even in the face of flat or declining volumes.

Another layer of change is cultural. In 2023, 23% of all children born in the EU had mothers born abroad. This trend is particularly visible in Luxembourg, Cyprus and Malta. Changing family structures and cultural references are reshaping expectations around hygiene. Product language, design and distribution need to reflect a broader spectrum of practices and needs. For brands, this shift means adapting not just formats but the entire way they relate to consumers.

Consumer priorities in an uncertain economic climate

The current economic environment adds another dimension to the hygiene market. In 2024, 54% of Europeans say they feel pessimistic about their country’s economic prospects. Only 40% feel secure in their own financial situation. This uncertainty is reflected in cautious, highly selective purchasing behavior.

Essential categories like disposable hygiene remain central in daily life, but consumers now weigh their choices carefully. In a 2024 survey, 59% of the respondents listed value-for-money as their main purchasing factor, followed by low prices (47%) and the ability to save (45%).[4] Inflation is reinforcing this trend. With rising living costs, many turn to store brands, multipacks, or promotional offers. Yet the expectation of quality remains intact. Consumers are not only looking for low prices. They want reliable, safe, and effective products that fit into constrained budgets.

Interestingly, while European consumers express caution, their sentiment remains more stable than in the US, where recent tariff news has triggered a sharper rise in pessimism.[5]

Sustainability and regulation

Regulatory initiatives are quietly redrawing the perimeter of what is acceptable, desirable and strategic in the hygiene sector. Instruments such as the EU Ecolabel and the Nordic Swan Ecolabel are establishing benchmarks that go far beyond symbolic value.[6] Their criteria encompass raw materials, biodegradability, packaging, energy consumption and emissions. Though voluntary, these certifications are gaining weight in procurement decisions and consumer perception, especially as national legislations begin to echo the same priorities.

Consumer behaviour is moving in parallel. While not everyone checks for certifications, more and more people expect hygiene products to reflect a commitment to sustainability.

Eco-friendly trend across generations

Younger generations are emerging as key drivers of the shift toward sustainable consumption. They tend to favour brands that align with their environmental values and are often open to paying more when sustainability is clearly integrated into product quality. Yet, across markets facing economic strain, affordability and product reliability continue to weigh heavily in purchasing decisions. This openness to sustainable options is broadly shared: 74% of consumers appear willing to try eco-friendly alternatives, often without preconditions.

However, this enthusiasm is less pronounced among older consumers: 42% of those over 65 indicate they would require additional assurances before making the switch. In countries like France, this generational hesitation is particularly evident. For many, the decisive factors remain pragmatic, such as competitive pricing in Spain and perceived quality in Germany.[7]

This tension between aspiration and constraint creates opportunities for brands that can combine ecological responsibility with tangible everyday value. Products that succeed in this space are those that present sustainability not as an optional add-on, but as a natural and seamless part of the user experience.

Product innovation and trends on UE hygiene market

Innovation in hygiene today responds directly to the changing habits and expectations of consumers. Biodegradable, compostable and bio-based solutions are gaining visibility, particularly in baby and menstrual care, driven by demand for safer, simpler and lower-impact materials.

Meanwhile, product performance remains central. Skin protection and premium absorbency are constantly being refined. Improved fit and comfort, including anatomically shaped products especially in adult incontinence care, are no longer optional in premium ranges, where expectations around dignity and mobility are high. Hybrid formats, such as reusable pants with disposable inserts or pads, are gaining traction for their ability to combine the sustainability of reusable solutions with the practicality and performance of disposable components.

In more specialized segments, the industry is exploring medical and health predictive features, particularly in menstrual, elderly or dependent care. These innovations are still emerging, but they suggest a possible future where hygiene products support not just cleanliness and comfort, but broader health management as well.

Strategic recommendations for hygiene brands

For brands operating in the European hygiene market, adaptation is a strategic necessity. Efficiency in production and distribution is a starting point. Optimizing lines, reducing waste and improving delivery systems can preserve margins in a price-sensitive context without sacrificing product quality.

At the same time, aligning with sustainability standards is becoming a reputational asset. Consumers pay attention to the transparency of sourcing, the clarity of labeling and the visible actions brands take on waste and materials. Those who act early and communicate consistently tend to build stronger equity over time.

Omnichannel presence is now essential. A strong position in traditional retail must be matched by agility online. Subscription models, mobile-first marketing and flexible pack sizes allow brands to meet consumers where they are, whether at home, on social platforms or in the supermarket aisle.

Product architecture matters too. Offering a tiered portfolio, with both basic and premium lines, allows brands to respond to diverse needs without losing coherence. The most successful players are those who create options, not confusion.

Finally, loyalty is still built through consistency. Clear value, reliable performance and authentic engagement remain the foundation of long-term consumer relationships, even in a competitive and fast-evolving market like hygiene. According to Salsify’s “2025 Consumer Research” report8, 87% of global consumers are willing to pay more for products from brands they trust. Trust, in turn, is driven by product quality and value (69%), brand reputation (69%) and customer experience (61%).9

Outlook and strategic opportunity

The European disposable hygiene market continues to offer significant opportunity for those ready to act with precision. It’s a landscape where demographic aging meets consumer savviness, where sustainability converges with pragmatism. By aligning with evolving values, optimizing product delivery, and innovating across categories, brands can thrive in this mature yet dynamic arena.

Eager to deep dive? Get actionable insights on the European disposable hygiene market trends. Book a session with GDM team, today.