The Pet Pad Market Expansion: Why Manufacturers Should Invest in Advanced Production Technology

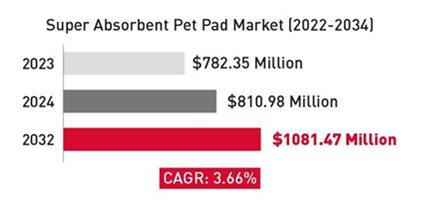

The absorbent pet pad market is entering a sustained growth phase, projected to increase from USD 1.25 billion in 2024 to USD 2.10 billion by 2033, reflecting a 7.2% CAGR. This growth is driven by several key factors: rising urban pet ownership, the growing trend of consumer premiumization (with 68% of Gen Z and 69% of Millennials treating pets as family members), and the rapid expansion of e-commerce in major markets. Within this market, the super-absorbent segment is expected to grow from USD 782.35 million in 2023 to USD 1,081.47 million by 2032, representing a strategic opportunity for manufacturers with advanced production capabilities.

Regional Market Analysis: Where Growth Is Concentrated

North America: The Dominant Market

North America holds the largest market share and represents the primary revenue opportunity for pet pad manufacturers. The United States and Canada feature high pet ownership rates combined with strong purchasing power, creating sustained demand for premium absorbent pet care products. The market benefits from mature retail infrastructure, high disposable incomes that enable premium product adoption, and e-commerce penetration projected to reach 43% of pet care retail value by 2025.

Its size, market stability, and strong consumer purchasing power position North America as the primary strategic focus for manufacturers. The region not only offers a large and reliable customer base for premium pet pad products but also provides predictable demand patterns that support long-term production planning and operational efficiency.

Europe: Steady Growth with a Sustainability Focus

The European pet pad market continues to demonstrate steady growth, particularly in Germany, France, and the United Kingdom. European pet care overall is expanding, with rising pet ownership across the region — more than 90 million households in Europe own at least one pet, reflecting broad and sustained demand for pet products.

Rising urban pet ownership combines with a strong consumer preference for eco‑friendly and biodegradable materials, supported by stringent environmental expectations and product innovation. European consumers are increasingly willing to invest in premium products aligned with environmental values, with a growing share choosing recyclable or biodegradable variants in pet hygiene and accessories.

Manufacturers targeting Europe should prioritize sustainable production capabilities and environmentally responsible materials to meet this demand segment and remain competitive in a market where sustainability is increasingly a differentiator.

Asia-Pacific: High-Growth Opportunity

The Asia‑Pacific region offers the highest growth potential for pet pad manufacturers. China, India, and Japan are seeing rapid increases in urban pet ownership, while rising incomes and e-commerce — nearly 60% of China’s pet care retail value in 2026 — are expanding premium product adoption. Pet humanization trends in Japan and South Korea further drive demand for high-quality indoor hygiene solutions.

The APAC pet pad market is valued at USD 305 million in 2026 and is projected to reach USD 525 million by 2035 (~6.6% CAGR). Urbanization, middle-class growth, and digital retail infrastructure create significant opportunities for manufacturers focusing on volume, innovation, and e-commerce channels.

Middle East & Africa: Emerging Market

While still at an earlier stage compared with North America, Europe, and Asia‑Pacific, the Middle East & Africa (MEA) region is emerging as a meaningful growth market for pet care products — including absorbent pet pads.

The MEA pet pee pads market was valued at approximately USD 150.8 million in 2024 and is expected to reach USD 300.2 million by 2035, expanding at a ~6.5% CAGR during that period, supported by rising pet ownership, urban lifestyles, and increased demand for convenient indoor hygiene solutions.

Market Drivers: Understanding the Growth Dynamics

The expansion of the pet pad market is driven by interconnected demographic and lifestyle shifts that generate sustained demand for indoor hygiene solutions. Urbanization plays a central role, as more pet owners live in apartments or homes with limited outdoor space. This constraint makes traditional outdoor waste management impractical, increasing demand for convenient indoor alternatives that maintain household cleanliness.

Busy lifestyles, especially among working professionals, further amplify demand for products that simplify pet care routines. Pet pads provide a practical solution for owners who cannot offer frequent outdoor access during work hours, reducing stress for both pets and owners while maintaining hygiene standards. This convenience becomes increasingly valuable as urban work schedules intensify and commute times grow longer.

Pet life stage needs also drive market segmentation and growth. Puppy training is a significant use case, requiring consistent indoor solutions before outdoor habits are established. Senior pets with mobility challenges or incontinence create ongoing demand for absorbent products that preserve comfort and dignity. Additionally, medical recovery situations, such as post-surgery care, generate further demand for specialized hygiene solutions that protect healing animals while keeping homes sanitary.

Rising awareness of pet health and hygiene reinforces these trends. Owners increasingly recognize that clean living environments directly affect animal wellbeing, fostering willingness to invest in high-quality hygiene products. This awareness extends beyond basic cleanliness to include odor control, bacteria prevention, and overall household harmony, elevating pet pads from simple convenience items to essential care products.

Consumer Requirements: What Defines a Successful Product

Competitive positioning in the pet pad market is defined by three fundamental requirements:

- Absorbency: Absorbency remains the primary performance criterion. Consumers expect multi-layer structures with super-absorbent cores that lock in liquid efficiently and prevent leakage. Consistency across the pad surface is critical — uneven weight distribution creates weak points where leakage can occur, undermining the product’s core value proposition.

- Size Adaptability: Pet pads must accommodate different breeds and specialized needs, including multi-pet households. Effective design requires strategic placement of absorbent zones for each size category, ensuring consistent performance and meeting diverse consumer requirements.

- Odor Control: Odor management is key to user satisfaction and repeat purchases. Materials that neutralize or contain odors contribute directly to household comfort. This requirement is particularly important in apartment settings with limited ventilation, making effective odor control essential for premium positioning and brand loyalty.

Market Challenges: What Manufacturers Must Address

Manufacturers entering or expanding in the pet pad market face three interconnected challenges:

- Environmental Concerns: Growing pressure exists for sustainable solutions, with European markets particularly demonstrating strong preference for eco-friendly alternatives despite premium pricing. Manufacturers must balance sustainability goals with performance requirements and cost constraints.

- Cost Pressures: As the market matures and competition increases, the gap between premium and economy products creates margin pressure for manufacturers who must optimize production costs while meeting rising quality expectations.

- Raw Material Availability and Price Fluctuations: Super-absorbent polymers depend on petrochemical feedstocks subject to global commodity price movements. Manufacturers with production systems that optimize SAP utilization gain a competitive advantage through reduced material dependency and improved cost stability.

The UP Plus Platform: Technology Built for Market Requirements

GDM's UP Plus platform addresses the pet pad market's critical requirements through three integrated capabilities.

The GDM Core Plus technology optimizes core formation by integrating fluff and SAP, achieving lower weight variation across core sections (under 7% versus the industry standard of 30–40%), and ensuring consistent absorbency performance without leakage weak points. Multi-layer structures provide the odor control and premium positioning that consumers demand. The Zero Time size-change capability with e-cam technology allows rapid adjustments to accommodate different pet breeds and life stages without downtime, directly addressing the market requirement for size adaptability across diverse consumer segments.

The platform delivers up to 30% cost reduction versus standard drum forming methods through optimized SAP utilization, directly mitigating raw material cost pressures and supply chain volatility. GDM Core Plus technology achieves equivalent absorption performance at the lowest basis weight (starting from 20 gsm), reducing material dependency while maintaining quality. Production speeds of 500–750 ppm, combined with reduced packaging and transportation costs from thinner products, strengthen competitive positioning in price-sensitive segments.

GDM offers two configurations: UP5 Plus and UP7 Plus, both incorporating Zero Time and GDM Core Plus technologies to optimize quality, adaptability, and cost efficiency required for market success.

Next Steps for Manufacturers

The pet pad market's 7.2% CAGR reflects sustained and predictable growth, underpinned by long-term demographic trends, rapid e-commerce expansion, and increasing consumer premiumization. For manufacturers evaluating investments in production capacity, a range of high-growth regional markets offers opportunities for geographic diversification and revenue expansion.

At the same time, advanced production platforms such as UP Plus provide competitive differentiation by enabling superior product quality, improved cost efficiency, and enhanced operational flexibility — allowing manufacturers to respond quickly to evolving consumer preferences and emerging market demands.

Contact GDM to explore how UP Plus technology can support your production strategy and market positioning in the expanding pet care hygiene sector. Our technical team can provide detailed specifications, ROI projections, and customized solutions for your manufacturing requirements.

Sources

- Global Growth Insights (2025). Super Absorbent Pet Pad Market Size, Share, Growth, and Industry Analysis

- Puri, S. (2025). Pricing Pressure, Premiumisation and Pet Health: Trends Shaping Global Pet Care in 2025. Euromonitor International

- MetaTech Insights (2025). Pet Pee Pads Market Analysis: Global Market Forecast 2025-2035

- Metatech Insights (2025). Middle East & Africa Pet Pee Pads Market Size, Forecast and Trends 2025‑2035.

- Metatech Insights (2025). Asia Pacific Pet Pee Pads Market Size & Forecast 2025‑2035.

- Forbes, S.L. (2018). Pet Humanisation: What is it and Does it Influence Purchasing Behaviour? Journal of Dairy & Veterinary Sciences, 5(2)

- Verdon, J. How the Pet Humanization Trend Is Creating New Brands and Business Opportunities. U.S. Chamber of Commerce