The omnichannel approach in the Disposable Hygiene business: how to

The COVID-19 pandemic has marked a turning point for retailers and brands. There’s been a dramatic shift in consumer behavior. While a few changes were temporary in nature, many have had long-lasting effects that will extend far beyond the so-called "return to normal."

Between late February and mid-March 2020, people started stockpiling in anticipation of the upcoming lockdown, especially hygiene products. This behavior resulted in empty shelves in shops and supermarkets, strangling the supply of goods[1].

This was a temporary effect. According to a recent study published on PLOS One[2], the widespread panic buying at the onset of the pandemic was nothing but the consequence of consumer anxiety and scarcity. In fact, as soon as the initial fear was over, people returned to budget-conscious spending once again.[3]

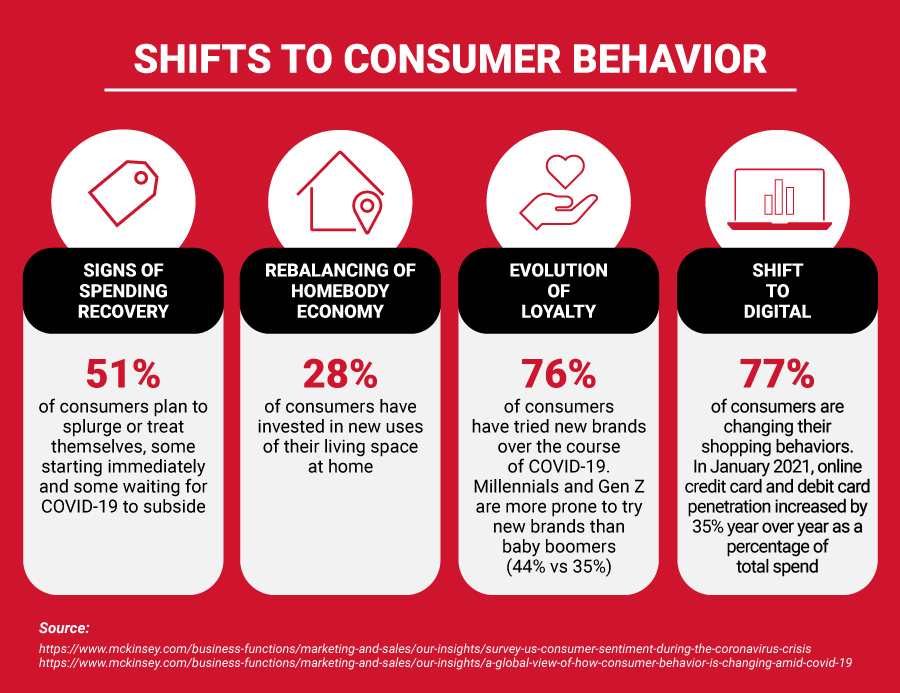

New buying patterns quickly emerged. With global supply chains in short circuit, customers had to make up for the lack of familiar brands in their favorite stores. Because of this, many discovered or looked for different products, igniting competition. Brand loyalty towards traditional brands plummeted. As reported by McKinsey, 75% of Americans have changed brands during the pandemic. Of these shoppers, 70% intends to continue searching for new ones[4]. According to McKinsey, the "most successful retailers will be those that connect with consumers in new ways by leaning in on their digital, omnichannel and in-store technology ambitions[5]."

Personal safety[6] and hygiene[7] became top priorities for shoppers, greatly reducing in-store transactions in favor of online purchases, resulting in an increase by 6 to 10 percentage points in e-sales across most product categories[8]. Several customers decided to shop elsewhere, either physically or by jumping from offline to online retail channels.

This has turned the customer journey on its head. The pandemic has made online shopping routine, bringing many buyers of Disposable Hygiene products on the internet for the first time. After stay-at-home orders were lifted, people were already used to searching for information and scouting for options tailored to their needs. In other words, they have become value shoppers.

Manufacturers and retailers had to rapidly adapt to fast-changing market conditions, venturing into uncharted waters such as direct-to-consumer marketing, subscription services and offline-to-online integration – a value creation approach known as "omnichannel".

The omnichannel approach: what is it and why you should care about it

With the web and mobile revolution, the multichannel approach became the standard. Indeed, customers feel an ever-growing need to engage with brands through multiple touchpoints, be they physical (shops, pop-up stores, private labels) or digital (app, email, instant messaging or social media). Often, though, they are unsatisfied due to a lack of synergy between the offline and online world. That’s where omnichannel comes in.

Omnichannel is the natural evolution of multichannel. It refers to the integration of different touchpoints within a unified customer experience. Once at the forefront of brick-and-mortar store innovation, omnichannel has turned into a necessity for retailers and manufacturers around the world. At the start of the pandemic, with clients no longer willing to shop in person, companies faced a tough choice: adapt or die.

A few Disposable Hygiene enterprises, such as Direct-To-Consumer (DTC) brands quickly adjusted their strategies, focusing on storytelling and engaging marketing campaigns.

Private Labels, with the aim to increase online and offline sales, embraced the startup culture, widening the range of products with specialty and premium brands built upon their solid know-how in conversational marketing and a growing customer niche.

The three pillars of the omnichannel strategy

Three are the main pillars of omnichannel: commerce, personalization and ecosystem.

The first approach concerns cross-channel connections. At a higher level it has to do with targeted offerings and the option to easily integrate offline and online channels or switch from one to another without any issues. Examples include allowing customers to buy-online-pickup-in-store (BOPIS), order online and deliver at home and loyalty or subscription programs.

Personalization is the enhanced version of retargeting and lookalike segmentation. As of today, most customers are looking for personalized shopping experiences. As reported by a survey of 1,000 adults by Epsilon and GBH, the vast majority of consumers expect personalization from retailers. Features such as multiple, personalized touchpoints, tailor-made offers and one-to-one interactions are in high demand[9]. When executed properly, this strategy provides rich, customer-specific in-app messaging and content, in-person consultations, going as far as to employ machine learning algorithms to identify the best-in-class product for the customer’s specific needs.

Ecosystem is the most advanced of the three omnichannel strategies. It consists in the creation of an overarching brand experience through a community of real people that engage with each other - not just as customers but as enthusiasts and brand ambassadors. It requires huge investments. Most importantly, the company needs to grasp the concept that omnichannel is not all about sales: markets are conversations[10]. In light of this, providing information hubs is key to building trust across the community.

To wrap up, customers demand cohesive storytelling across all channels, 24/7 support and engagement, personalization and, most importantly, they want to be involved in the brand's ecosystem at a deeper level.

For this to happen, corporations should focus on data coming from alternative touchpoints, so that a customer which mainly interacts online is not a stranger when they visit the brand's brick-and-mortar stores.

However difficult to pull off, the omnichannel approach represents an invaluable opportunity for every market player. According to Market Watch, the global omnichannel retail commerce platform market is expected to grow from $2.99 billion in 2017 to $11.01 billion by 2023, at a CAGR of 21.48% during the forecast period[11].

A unique partner to rely on could simplify your omnichannel business

The profound changes in consumer behavior represent a watershed moment for market leaders and DTC brands that want to start or adapt production.

Part of Coesia, a group of highly innovative companies specialized in industrial primary and secondary packaging solutions, GDM can support customers as a unique technological and consulting partner, generating value in each and any aspects of their business through advanced services and programs. This is what we call Business Made Easy.

Thanks to this program, GDM can follow you every step of the way along the entire supply chain, providing a truly comprehensive solution, from product development to production support with:

- Premium Product definition: design with an upgraded core for a better performance through Extra Thin Core technology and premium raw materials running at high speed;

- Integrated solution: converting machines, primary and secondary packaging, training sessions and a contract on Asset Protection Services (APS);

- One partner for the whole project: from idea generation to support during production, GDM is responsible for the whole project.