Disposable hygiene in Southeast Asia between rising demand and new realities

What happens when 687 million people across eleven countries[1] begin to earn more, live longer, shop online and raise their expectations of daily life? Southeast Asia provides the answer, creating one of the world's most dynamic hygiene markets.

This is a region in flux, economically, demographically and culturally. Large populations in Indonesia and the Philippines are entering their most consumption-active years, while more mature markets like Singapore and Thailand are adapting to aging societies and rising care needs. Across the board, consumers are making more deliberate choices about the products they use, and how they buy them.

In 2024, 44.1 billion hygiene units were sold across the region, generating €6.45 billion in retail value[2]. Yet understanding Southeast Asia today means looking beyond simple growth curves, and paying attention to the signals quietly, but fundamentally, reshaping the hygiene landscape.

Inside Southeast Asia’s hygiene expansion

Where mature markets, such as the European disposable hygiene market, are refining existing categories, Southeast Asia is expanding them, broadly and rapidly. Here, expansion cuts across all product categories (baby, menstrual and incontinence care) driven by everyday improvements in living standards and shifting expectations around personal care.

Across the region, urbanization is accelerating, mobile-first behaviors are reshaping how people discover and buy, and ASEAN frameworks are quietly increasing regional connectivity. These forces are transforming how consumers interact with brands, especially in digital and health-driven channels.

Southeast Asia has shown solid economic performance in recent years, with GDP growth reaching up to 5% in key markets like Indonesia and Vietnam. But 2025 has introduced new headwinds: trade tensions, subsidy-driven price controls and policy uncertainty are beginning to test the resilience of this growth.

Despite these pressures, the hygiene market continues to expand, shifting in volume, value, and consumer expectations. In fact, Asia Pacific alone is projected to account for 37% of global retail growth in hygiene between 2024 and 2029[3].

Retail disposable hygiene market overview: data for 2024 & beyond

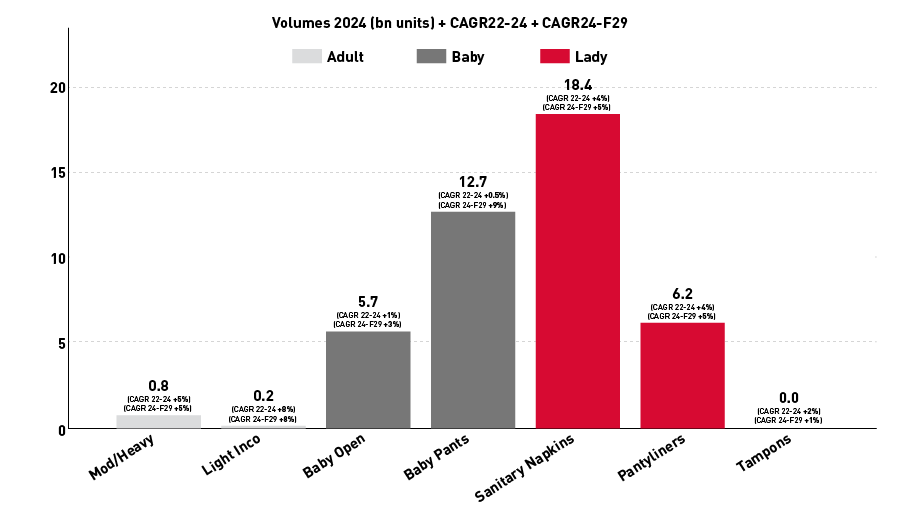

Source: Euromonitor 2025- data refer to 2024 Retail only (AFH is not included), CAGR 2022-2024 and CAGR 2024-Forecast 2029, fixed 2024 exchange rates; individual values are rounded and may not total 100%

Each category tells a different story, shaped by demographic patterns, consumer behavior and purchasing power.

Baby care commands the largest volume with 18.4 billion units. The transition from traditional diapers to pants confirms a pattern seen in the latest years, pushing baby pants growth to +9% volume and + 13% value CAGR through 2029. This rise accurately aligns with the demographic and spending dynamics driving change across the region.

Incontinence care represents the highest growth opportunity despite smaller absolute volumes. Products for moderate to heavy incontinence are expanding at +12% volume and +18% value CAGR, indicating both increased usage and successful premiumization.

Menstrual care maintains steady fundamentals with 24.6 billion units, led by sanitary napkins achieving +10% value CAGR. This value-over-volume growth suggests consumers are migrating toward higher-quality options as awareness and purchasing power increase.

Disposable hygiene retail distribution channel

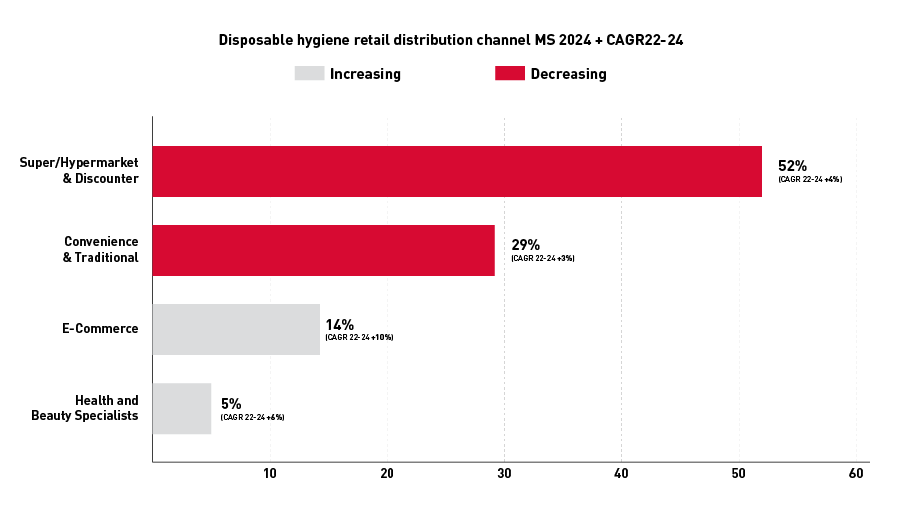

Source: Euromonitor 2025 - data refer to 2024 Retail only, fixed 2024 exchange rates, CAGR 2022-2024; individual values are rounded and may not total 100%

A closer look at retail distribution highlights how digital transformation is driving new commerce patterns across the region. While supermarkets and hypermarkets retain dominance at 52% market share, e-commerce platforms have captured 14% share with accelerating +10% growth rates.

Reasons, drivers and trends: what lies beneath the growth curve

The data tells us where the market is growing, but to understand why and what comes next, we need to look deeper at the demographic, economic and cultural forces at play.

Demographic contrasts create distinct market opportunities

The region's population profile presents a rare duality[4]: countries like Indonesia and the Philippines have large, young populations with strong potential for long-term baby care demand, while others (such as Thailand and Singapore) are beginning to experience the challenges of aging societies.

This divergence creates opportunities across multiple product segments. In younger countries, large birth cohorts and rising living standards continue to support volume growth in baby care. Meanwhile, in more mature economies, adult incontinence products are gaining relevance, driven by demographic trends and increasing openness around care needs.

These demographic forces are not uniform. Southeast Asia's eleven countries differ widely in age structure, fertility rate, and urbanization. This variety contributes to extended growth cycles across hygiene categories.

The economic momentum enables premium market expansion

Several economies in the region, particularly Indonesia and Vietnam, have delivered GDP growth near 5% in recent years[5]. This performance is enabling more consumers to access hygiene products that align with rising expectations for comfort, convenience, and quality.

At the same time, price sensitivity remains a key factor. While demand for higher-value formats is increasing, affordability continues to shape buying decisions, especially outside of major urban areas. Manufacturers who offer clearly positioned products at multiple price points are better equipped to serve this diverse consumer base.

Some governments are also encouraging investment in domestic production capacity. These efforts aim to strengthen local supply chains and reduce dependance on imports, although their implementation varies by country.

Women's growing influence amplifies these consumption trends

As women's participation in education and employment increases across Southeast Asia, their role in household purchasing decisions becomes even more influential. While levels of gender inequality remain moderate to high in most ASEAN countries[6], upward trends in economic and social engagement are visible.

Greater awareness of menstrual health and hygiene, especially among younger women, is contributing to the expansion of the menstrual devices category. Women also play a central role in selecting products for baby and family care, making them a critical target group for manufacturers.

Regional initiatives to strengthen the care economy, including expanding childcare services and enhancing parental support policies, are gaining momentum across ASEAN countries[7]. These developments may further influence how families approach hygiene consumption in the coming years.

Digital platforms increasingly capture the evolving demand

The region's digital economy is forecasted to reach $1 trillion by 2030, driven by increased connectivity and consumer adoption[8]. Southeast Asia has also been one of the fastest growing regions for Internet penetration, with a CAGR of 13% between 2011 and 2016, compared to a global average of 8%[9].

Hygiene products are increasingly sold online, with platforms like Lazada and Shopee enabling wide access for both global and local brands.

E-commerce now represents 14% of retail hygiene sales in Southeast Asia, with a CAGR of +10% between 2022 and 2024[3]. This growth highlights the importance of integrating digital channels into distribution strategies, particularly as mobile-first shopping habits become more widespread.

While traditional retail formats remain dominant, the continued rise of online purchasing is reshaping how hygiene products are marketed, discovered, and delivered.

Chinese brands now challenge established market dynamics

China became Southeast Asia's largest trading partner in 2024, accounting for $587 billion in exports and recording 12% annual growth[10]. This economic presence is increasingly felt in the consumer sector, where Chinese hygiene brands are gaining visibility.

Competitive advantages such as aggressive pricing, rapid innovation cycles, and strong online presence are helping these brands expand across Southeast Asia. Their growing influence is adding pressure on both local and international players to respond with faster, more adaptive strategies.

Strategic pathways: building sustainable competitive advantage

Success in Southeast Asia's dynamic hygiene market requires focused execution across four critical areas that distinguish market leaders from followers.

Operational efficiency remains a core enabler. In a region defined by pricing sensitivity and logistical diversity, companies must optimize manufacturing, distribution, and supply chains to stay competitive while serving markets with varying product requirements.

Digital engagement is no longer optional. With e-commerce steadily gaining share and consumer behavior increasingly mobile-led, brands need to meet shoppers where they are, whether on established platforms or through direct digital channels.

Segmentation and localization are critical in navigating Southeast Asia’s fragmented demand landscape. The ability to adapt product formats, communication strategies, and pricing to specific audiences, within and across countries, is a defining trait of successful market players.

Brand trust and consumer connection help build long-term stability. In a region where competition is intensifying, especially from new entrants, companies that deliver consistent quality and build relevance through education or community presence can establish more durable relationships with consumers.

Together, these four levers form the strategic foundation for navigating Southeast Asia’s hygiene market with both vision and purpose.

Future outlook: sustainable growth through strategic commitment

Southeast Asia offers vast and long-term potential for hygiene brands that are ready to invest in understanding this complex and fast-evolving region. Its favorable demographics, economic momentum, and expanding digital infrastructure make it one of the most dynamic consumer markets globally.

But unlocking this potential requires more than scaling existing playbooks. With eleven countries at different stages of development (each with its own regulatory, cultural, and economic environment) success depends on agility, deep local insight, and sustained market presence.

Manufacturers that thrive in Southeast Asia will be those able to adapt to shifting consumer needs, respond to digital and demographic trends, and build meaningful connections with diverse communities. While competition is intensifying, the core drivers of demand remain strong.

Ready to unlock Southeast Asia’s hygiene market potential?

Get tailored insights on market trends, consumer behavior, and competitive dynamics. Book a dedicated session with the GDM team to translate market data into a winning strategy for your regional growth plans.