Are Africa and the Middle East tipping the balance of the Global Baby Diaper market?

The Global Baby Diaper market: an overview

In the changing global landscape of Baby Diapers, while the EU suffers from negative value growth and North America struggles with stagnation, Africa and the Middle East become critical areas of expansion.

This shouldn't take anyone by surprise. After all, the Baby Diaper market is, to a certain extent, positively correlated with population growth. On this note, Europe and the US are on the other side of the spectrum, as they collectively represent the largest Adult Inco market worldwide, with a combined share of 53.8%.

On the other hand, the world’s fastest-growing populations are in the Middle East and Africa[1]. By 2030 one in five people will be African[2] - two in five by 2050. In fact, birth rates are forecast to remain stable, if not increasing, in both regions[3].

In summary, the upside potential is much greater for these two areas, as average living standards have plenty of room for growth. As far as market penetration is concerned, most opportunities in Baby Diapers are in Africa and the Middle East, where affordability plays a major role.

Africa and Middle East: the latest figures

In the international panorama, Africa holds a unique position. A year-over-year population growth of 2.49%[4], a steady decline in the infant mortality rate(-2.6% from 2020)[5], a rising disposable income, an urbanization rate among the fastest in the world[6] - all these factors bode very well for the region.

As regards the Middle East, thanks to the introduction of sanitation measures and modern medicine, the mortality rate has dropped dramatically. Income inequality between countries, largely due to the geography of oil ownership, is particularly high in the region and governments struggle to close the gap between the rich and poor providing essential necessities.

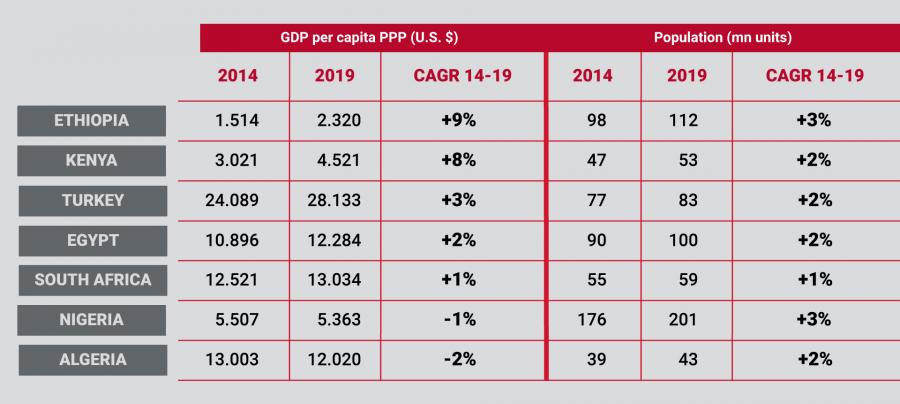

That said, Africa and Middle East countries are profoundly diverse. The regions are speckled by a myriad of ethnicities, cultures, religions and socio-economic realities. Indeed, a few countries hold the lion's share of areas GDP, while others follow from afar.

Population: Department of Economic and Social Affairs (UN)

Inside Africa's and Middle East's Baby Diaper market

In the African Baby Diaper segment affordability is a huge and common factor, dominated by Baby Open format. While in some countries the traditional hourglass design originating from China is all the rage, the main trends are front and rear wings as well as product innovations, like core developments and anti-leakage features.

Compared to the continental average, East Africa, shows a better real GDP growth. Here multinationals are the trendsetter and local producers are following their footsteps, with imports from China, Turkey and the Far East trying to seize market share.

Product-wise, the premium segment is occupied by international brands, threatened by local producers targeting rural areas and smaller retailer channels with more affordable solutions. As a result, local players are slowly encroaching on multinationals' sales share. The landscape is even more complex if we consider that Chinese diapers are strengthening their presence, mainly due to powerful distribution networks.

South Africa is the top African country in terms of Baby Diaper's penetration. Despite the increasing unemployment rate, it ranks first in the continent by GDP. Indeed, the high disposable income is a magnet for established brands, that have invested a huge amount of capital over the years. In addition, the low per capita utilization makes South Africa an ideal market for those global players who want to secure their future growth.

Speaking of the Middle East, many Disposable Hygiene companies have two or three different product lines, so as to cater to a wide array of customers of every budget. Product-wise, Baby Open, as in Africa, is the most common item in terms of volumes in the whole Middle East, where the most part of manufacturers choose this format to enter the market.

Egypt is 40 in the IMF's list of countries by nominal GDP. The reason for this staggering success is largely due to the macroeconomic stabilization program, reduced debt to GDP ratio and a solid primary budget surplus.

In light of this, Egypt is already home to several international brands and, thanks to its close relationship with Turkey, benefits from a positive outlook in the landscape of the African Baby Diaper market.

Among the Middle Eastern countries, Turkey has a special role to play, being in close, lucrative relationship with both Nigeria and Egypt. The economic downturn still represents a slowdown for the region, marginally limiting purchasing power.

Premiumization is certainly a factor. Indeed, the defining feature for Turkey is its tendency to closely look at European trends. However, all that glitters is not gold, given that, with no positive signs pointing to a recovery for the economy, the slowdown in per capita volume consumption growth is set to continue, suggesting that affordability and value for money are bound to be a relevant factor for many years to come.

Product-market fit: the positioning of B6-W Red in Africa's and Middle East's Baby Diaper market

For manufacturers looking to get the best out of the African and Middle Eastern markets, B6-W Red represents an enticing opportunity.

Thanks to the process solutions proven on our best-selling lines, B6-W Red, running at 600ppm, ensures high reliability with stable performances and no stops.

The machine delivers baby diapers with cutting edge core technology and the option for permanent channels. Moreover, it enables an optimal mix and distribution of fluff and SAP while minimizing raw material costs thanks to Zero Waste design on both front & rear wings and the capability to run low gsm textures.

Not enough? With our B6-W Red solution you can take advantage of all the benefits of a single source supplier from converting to primary packaging, as our Business Made Easy concept drives our business model: check out the matching SB50 Red or SB50 GO stacker and baggers lines

To know more fill the format below for your Virtual Days, our online events to discover GDM machines, digital attendees will have the unique chance to experience our cutting-edge machine from up close in full, 360 degree.

Conclusion

The African and Middle East markets are wildly diverse and, at the same time, extremely promising. These two areas have all the characteristics that make for a great Baby Diaper market: strong population growth, rising living standards, improving disposable income. Combined with an improving consumer awareness, it makes the case for a growing African and Middle Eastern Baby Diaper market.