Africa: a golden opportunity for the Disposable Hygiene industry

Education rates are on the up, the infant population is growing and purchasing power is improving in Africa, making the Disposable Hygiene market a valuable opportunity for entrepreneurs wishing to invest in a new sector

The tides are turning for women and children in Africa

Countries on the African continent have historically struggled with lower levels of women’s education and participation in the labor force when compared to other regions with similar income levels. These issues have tended to take a back seat to more pressing matters, such as civil war and foreign intervention[1]. As such, progress has been incremental at best. The root causes of these issues are complex, but the ties between economic structure and cultural norms – in which gender roles are often strongly enforced – have had a large part to play[2]. As a result, cultural, political and religious inequities have tended to prevent women from accessing certain market sectors and influencing household finances[3].

There are still significant gaps in labor force participation between men and women; only 21% of women in Northern Africa and the Middle East currently participate in the labor force, compared to 61% in Southern Africa[4]. But the tides are beginning to turn for women throughout the continent. In recent years, women in Northern African countries such as Algeria, Egypt, Morocco and Tunisia have secured more rights and greater access to education[5], which has allowed them to move into the job market[6].

The rise in secondary school enrolment among girls has also helped to bolster access to the job market, increase women’s financial contributions to the household and improve overall national income as a result. In fact, economic parameters such as GDP per capita, financial development and trade openness are all positively and significantly associated with women’s participation in the labor force in Africa[7].

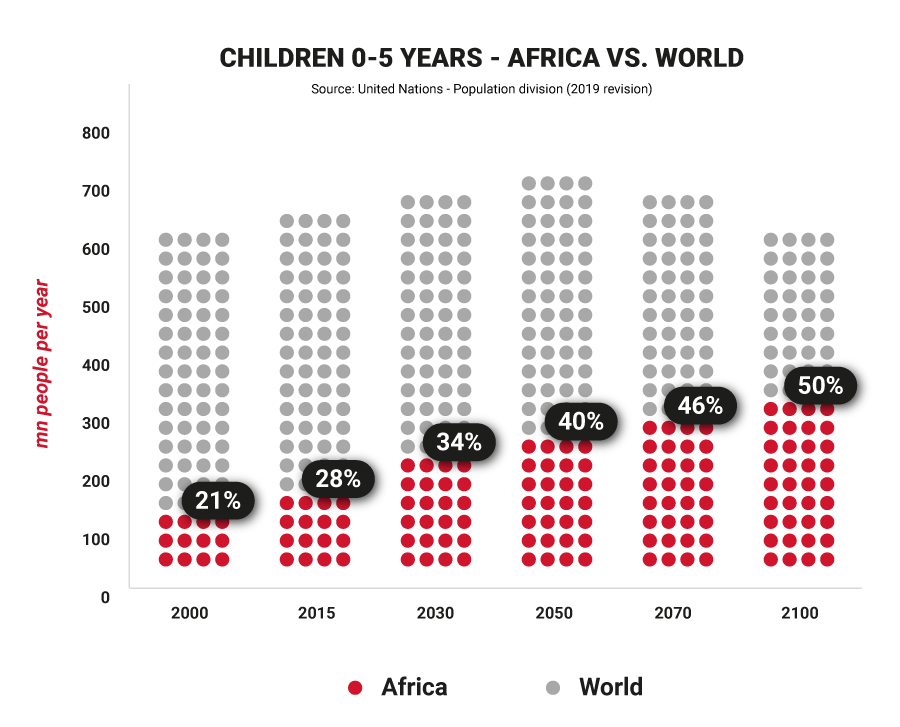

In addition, health has significantly improved in gender-related indices[8]. According to the World Bank, infant mortality has seen a significant decrease over the past sixty years[9] while UNICEF predicts that Africa will be home to almost 279 million children under the age of 5 by 2050, which is equivalent to 40% of the world's total[10].

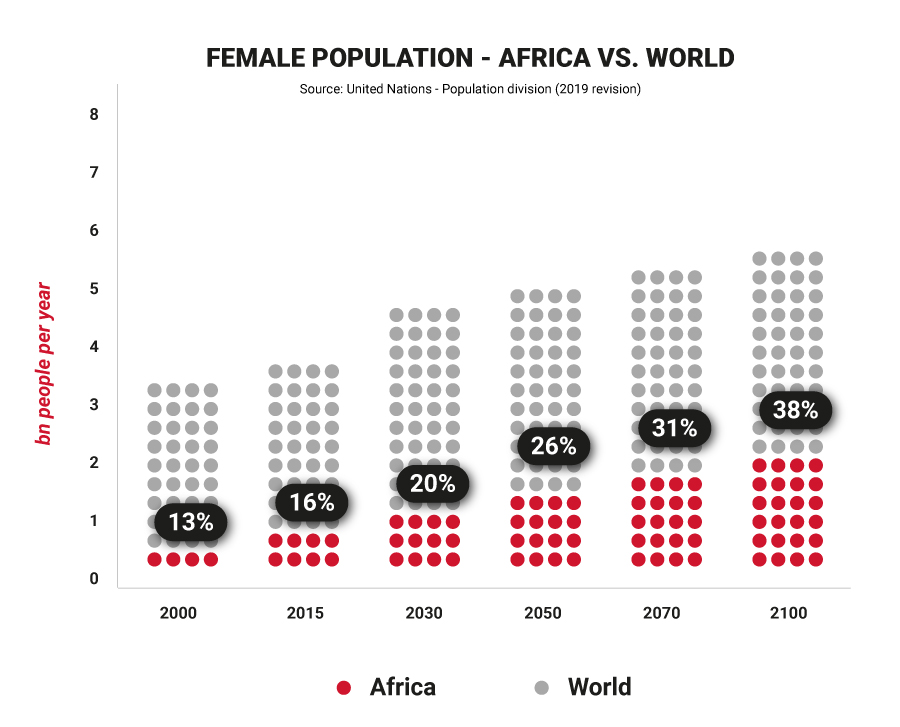

By 2050, 40% of all children and 26% of all women will live on the African continent[11]. And the rate of growth is rapid; the infant population is estimated to increase by over 12 million in the next five years alone[12].

By 2050, 40% of all children and 26% of all women will live on the African continent[11]. And the rate of growth is rapid; the infant population is estimated to increase by over 12 million in the next five years alone[12].

Unsurprisingly, the extraordinary growth in Africa’s infant and female population is impacting the Disposable Hygiene sector. As Africa’s population grows, so does the consumer base, as demand for hygiene products increases and sales volumes grow significantly.

Household purchasing power and the rising child population offer key opportunities for investment

Although women’s participation in the market economy has improved, their domestic workloads have not declined (counting an average of 4.5 hours a day) being responsible for the care of children and elderly family members, in addition to managing the household.

By 2030, total annual spending by African consumers across all sectors is projected to reach $6.66 trillion, an increase of $4 trillion on 2015[13].

In 2021, Africa’s Disposable Hygiene market was valued at €4.56 billion, with 31 billion units sold. Growth projections are currently very optimistic for the industry, with an estimated 13% increase in the retail value CAGR of the Disposable Hygiene industry between 2021 and 2026[14]. Here some projections:

Adult Inco, in 2021, showed good growth in both volume and value due to an aging population, increased domestic production and increased recommendations from doctors.

Baby Diapers is a growing category in terms of both volume and value. Diapers are an essential product, so they aren’t subject to economic downturns like other products. The largest segment is Baby Open, which is still growing steadily, with 19.6 billion units sold in 2021 alone (CAGR 21-F26 +6%).

Lady Sanitary Protection products are considered essential, so volume and value growth were equal to that of 2020, despite increasing price sensitivity and rising inflation (11 bn units sold, CAGR 21-F26 +6%).

Several international brands have already seized on the opportunities presented by Africa’s changing demographic context to invest in Baby Open, Adult Inco and Lady products. And the industry continues to grow.

At GDM, we can advise on investments and make business easy for entrepreneurs

We are a leading global player in the Disposable Hygiene industry and are joining forces with entrepreneurs in adjacent sectors to simplify the investing process, broaden portfolios, unlock the market’s full potential and make business easy.

Thanks to our guiding Business Made Easy principle, independently from the market segment, we can advise you on the full value chain, from the ground up. In details, our 360° support concerns:

- investment opportunities evaluation through tailor-made business cases, considering product and size mix, production needs and associated costs (labor and energy), distribution, profit margins and payback

- global and local market analysis - data and trends

- materials, thanks to our established network of raw material suppliers and technology partners

- financial services

- product development

- production processes, technology and plant requirements

- fully automated and integrated turnkey solutions – converting, packaging and end-of-line - with only one touch point

- after-sales customer service and big data analysis

In addition, consistent investments in R&D and innovative technologies for our engineering and production divisions have allowed us to make huge strides in the digital field, thus boosting procurement savings without compromising product quality and performance.

Are you interested in exploring the impressive opportunities coming from the African Disposable Hygiene industry? Get in touch today for a complete consultancy.